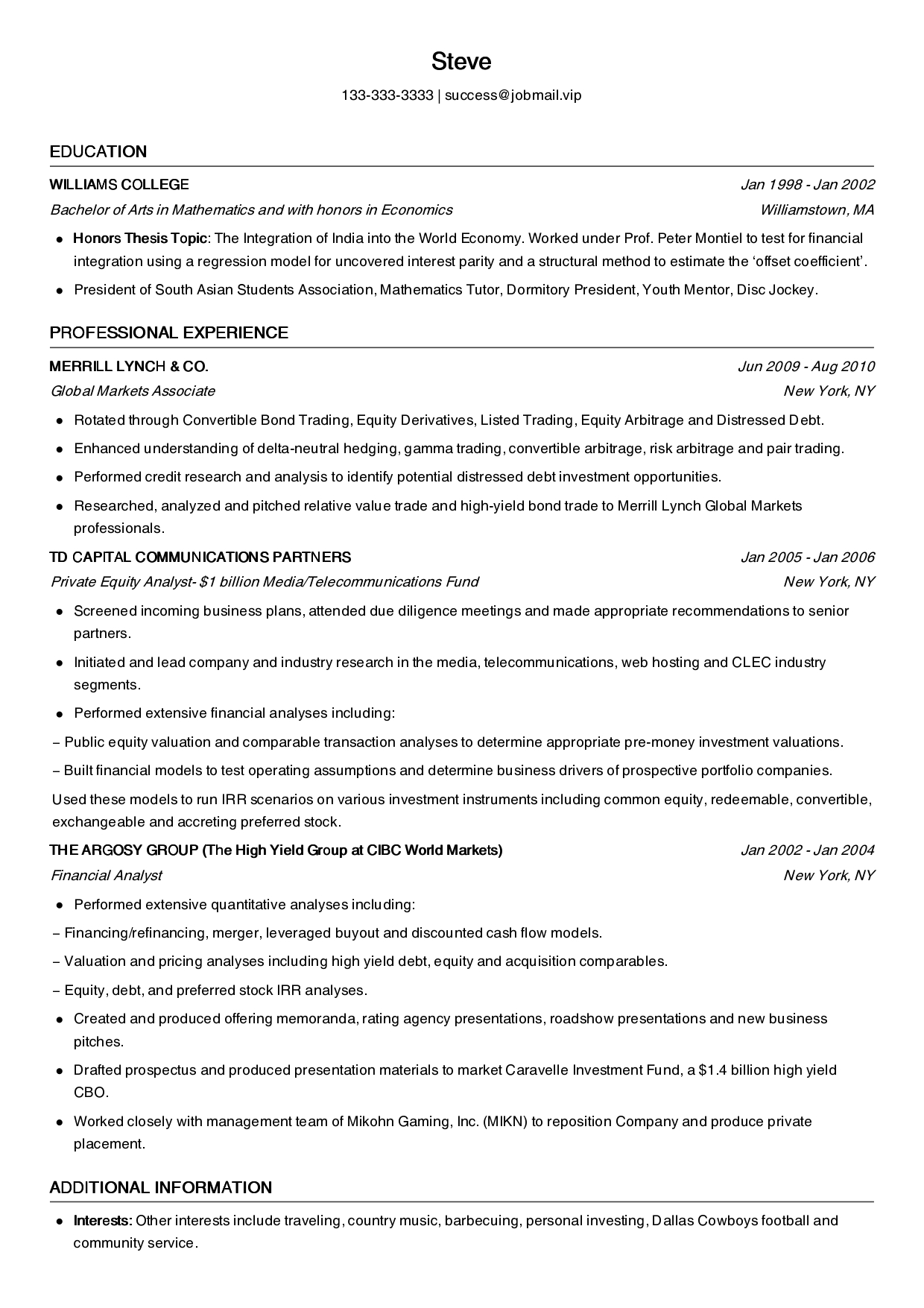

2026应届生英文简历模板,适合应届生招聘投递,也适合其他相关岗位简历参考

Steve

133-333-3333

success@jobmail.vip

EDUCATION

WILLIAMS COLLEGE

Jan 1998

-

Jan 2002

Bachelor

Williamstown, MA

- Honors Thesis Topic: The Integration of India into the World Economy. Worked under Prof. Peter Montiel to test for financial integration using a regression model for uncovered interest parity and a structural method to estimate the ‘offset coefficient’.

- President of South Asian Students Association, Mathematics Tutor, Dormitory President, Youth Mentor, Disc Jockey.

PROFESSIONAL EXPERIENCE

MERRILL LYNCH & CO.

Jun 2009

-

Aug 2010

Global Markets Associate

New York, NY

- Rotated through Convertible Bond Trading, Equity Derivatives, Listed Trading, Equity Arbitrage and Distressed Debt.

- Enhanced understanding of delta-neutral hedging, gamma trading, convertible arbitrage, risk arbitrage and pair trading.

- Performed credit research and analysis to identify potential distressed debt investment opportunities.

- Researched, analyzed and pitched relative value trade and high-yield bond trade to Merrill Lynch Global Markets professionals.

TD CAPITAL COMMUNICATIONS PARTNERS

Jan 2005

-

Jan 2006

Private Equity Analyst- $1 billion Media/Telecommunications Fund

New York, NY

- Screened incoming business plans, attended due diligence meetings and made appropriate recommendations to senior partners.

- Initiated and lead company and industry research in the media, telecommunications, web hosting and CLEC industry segments.

- Performed extensive financial analyses including:

− Public equity valuation and comparable transaction analyses to determine appropriate pre-money investment valuations.

− Built financial models to test operating assumptions and determine business drivers of prospective portfolio companies.

Used these models to run IRR scenarios on various investment instruments including common equity, redeemable, convertible, exchangeable and accreting preferred stock.

THE ARGOSY GROUP (The High Yield Group at CIBC World Markets)

Jan 2002

-

Jan 2004

Financial Analyst

New York, NY

- Performed extensive quantitative analyses including:

− Financing/refinancing, merger, leveraged buyout and discounted cash flow models.

− Valuation and pricing analyses including high yield debt, equity and acquisition comparables.

− Equity, debt, and preferred stock IRR analyses.

- Created and produced offering memoranda, rating agency presentations, roadshow presentations and new business pitches.

- Drafted prospectus and produced presentation materials to market Caravelle Investment Fund, a $1.4 billion high yield CBO.

- Worked closely with management team of Mikohn Gaming, Inc. (MIKN) to reposition Company and produce private placement.

ADDITIONAL INFORMATION

- Interests: Other interests include traveling, country music, barbecuing, personal investing, Dallas Cowboys football and community service.